The Morality of Money

‘Money, in the MOQ, is a pure and simple index of social quality.’

Robert Pirsig

‘Money, in the MOQ, is a pure and simple index of social quality.’

Robert Pirsig

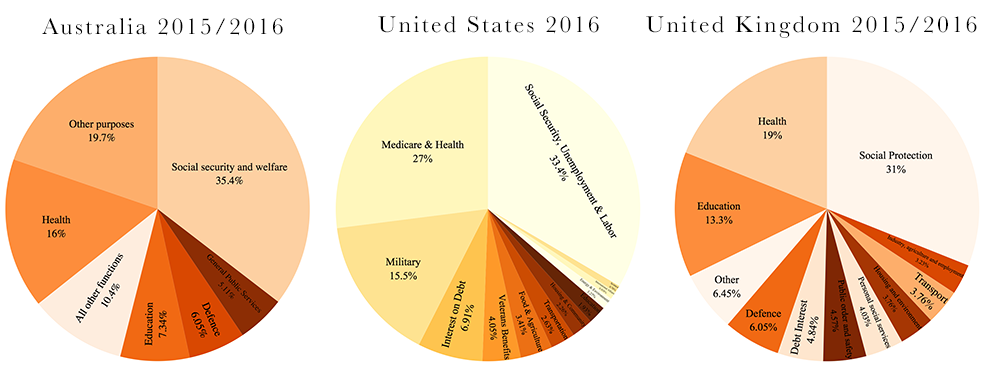

With money representing social quality, the direct link between a government’s budget and what it considers as valuable becomes immediately apparent. Looking at the budgets of the US, UK and Australia is therefore a great way to see what each culture deems valuable.

A lot can be said about a culture by what it spends its money on. In fact it could be said that a culture is what it spends its money on, because a culture is what it values. I won’t get into the details of each budget and the morality of each according to the MOQ in this post but first I just want to spend some time discussing the limits of a budget, what they’re thought to be, and what they actually are.

Basically, current economic thinking claims that budgets are constrained by their deficit. A government’s budget is compared to a household budget and deficits are seen as some kind of a sin to be avoided and surpluses are seen as a good to be continued. However the problem with this thinking is that a government’s budget is not constrained as per a household due to the fact that a government, unlike a household, can produce its own money without constraint. How then, did we end up with this discrepancy?

Historically, the value of money had been pegged against the gold standard, and as there was a limited supply of gold, there was indeed a limit to how much money could be spent relative to the amount of gold available. However in 1971 President Nixon ended international convertibility of the U.S. Dollar to gold and floated the currency. Since then, standard economic thinking doesn’t appear to have adapted to the fact that there is no longer such a restriction in the amount of money a government can produce!

That’s not to say there aren’t constraints however. Simply speaking, the true constraint to an economy is inflation when ‘too much money chases too few goods’. This isn’t a risk though, when the output(goods) of an economy isn’t at a maximum as would be the case when there is unemployment. Because of this, a government backed Job Guarantee, would be not only obviously good for the individuals unemployed, but a great way to keep an otherwise unemployed workforce, skilled and available for the private sector when required.

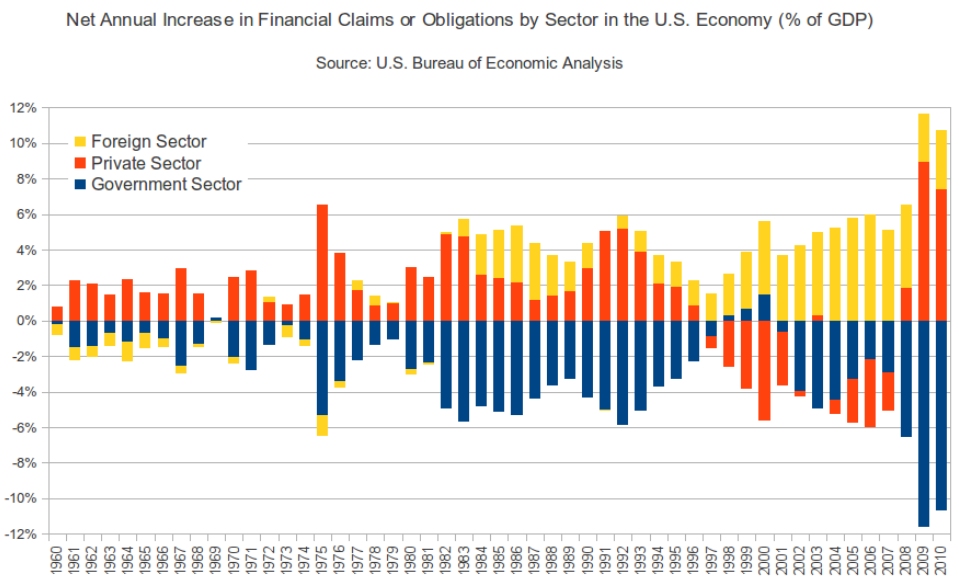

And this is the argument of Modern Monetary Theory(MMT), which supports not only a Job Guarantee but also government deficits. Deficits are seen as typical because the private sector, which would then be in surplus(graph above), values saving money for harder times. Such economic thinking, resulting in a great increase in the quality a society can produce, is strongly supported by the Metaphysics of Quality and why I’ve written about it here. MMT is becoming increasingly popular as an alternative to the austerity being applied to many struggling economies around the world.